Share this

2022 FMI (E+SD) Orlando Conference Offers Strategy Pathways for the Future

by Phoenix Energy Technologies on Oct 3, 2022

FMI Energy & Store Development's latest gathering in Orlando, Florida focused on strength through innovation, adjacent markets, supply chain intelligence, and inventory technology, along with trends and shifts in sustainability. Here is a recap of keynote speakers, industry contributors and other conference highlights.

The show opened with lots of networking opportunities on the Manufacturer and Retailer Exchange floor!

Three Successful Grocery Use Cases :

How to Achieve Energy Expense Savings to Meet Financial and Sustainability Goals

Our very own VP Michael McMahon presented several industry use cases to a packed audience with nearly 100 people in attendance. Successful grocery use cases consisted of examples on how several enterprises are successfully managing refrigeration performance optimization and HVAC optimization/engineered savings rates. The presentation additionally included explanations in system architecture and how to leverage existing equipment.

Stay tuned to this space for information on how to obtain a recorded presentation!

Innovation Through Adjacent Markets

Keynote speaker Patrick Schwerdtfeger kicked off the morning with his presentation on “Disruptive Innovation” coming from ‘adjacent markets’, often catching executives by surprise and invalidating existing business models. Examples he gave were of Apple getting into the music business, autonomous driving affecting the agriculture business with autonomous driving tractors, and digital signage allowing changes to restaurant menus and grocery shelf stickers to be quicker, cheaper and easier. Other examples included driving services such as Uber getting into the food delivery business, new advances with the telescope enabled the discovery of a new galaxy, and Kodak – who developed the digital camera but went bankrupt because they didn’t recognize the value of it got eaten up by their competitors who did. Patrick encouraged the audience to “Think Bigger, and inspire those around you”. “Disruptive markets come from the least profitable markets and the least profitable markets come from the most profitable markets”. Look up, down, left and right and in adjacent markets to find innovation. Stay on offense to protect yourself: ask what others are doing poorly. Ask yourself what you are doing poorly, “Who’s gonna eat our lunch, and who else’s lunch can we eat?”

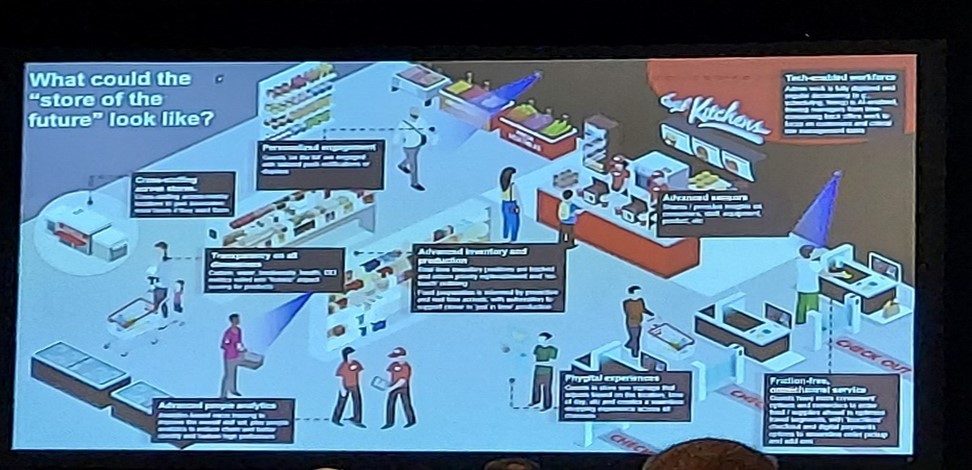

Inventory & AI Automation Strategy

Steve Hoffman of McKinsey & Company presented the “Store of the Future” and took us 8-10 years into the future to explore the impact current trends are having on the physical store in terms of Value, Purpose, “Phygital”, Talent and Investment. He gave examples such as smaller store footprints as transport as a service like Uber Eats gain more and more popularity; a tech-enabled workforce as AI and automation continue to evolve; and advanced inventory and production as technology evolves with real-time inventory positions, predictive arrivals and just-in-time production. Steve asked some key questions operations leaders can address over the coming years such as, “How do I start to pilot and scale new digital and analytics use cases? What is my ESG strategy, How do I create the right incentives / business cases for predictive maintenance? What benefits are important to my staff and how do I win on retention? What is my automation strategy, and How am I researching and leveraging technology partners and start-ups?"

Trends and Shifts in Sustainability

Tristam Coffin from Effecterra and Kathy Loftus of Retail Business Services presented on Sustainability and “Shrinking Your Carbon Footprint: Reducing Scope 1, 2 and 3 Emissions." They stated that the challenge is that building operations are responsible for 27% of annual global carbon emissions and building materials and construction are responsible for an additional 20% annually, and 80% of buildings that need to be decarbonized are already built.

- Scope 1 are Direct Emissions from owned assets such as refrigerants and fuel combustion for heating, kitchens, vehicles. Solutions are electrification of refrigerants, heat and vehicles.

- Scope 2 are energy indirect emissions such as purchased electricity, heating/cooling. Solutions are power purchase agreements, 24/7 carbon-free energy, onsite renewables and clean energy microgrids.

- Scope 3 are 3rd party indirect emissions not controlled by your organization such as supply chain, distribution, staff/customer travel and use of sold products. Solutions are using a supply chain that adheres to Scope 1 and 2, green leases and creating a circular economy.

Their presentation recommended that taking action requires recording and reporting, reducing, replacing and removing - with the goal of zero-carbon requiring a new paradigm and cited that 76% of global CEOs have indicated that navigating the shift to a low carbon, clean technology is their key business challenge.

Supply Chain Intelligence

John Anton from S&P Global Market Intelligence journeyed us through the sobering supply chain constraints, which sectors and products are most impacted, when to expect relief, and signs of risk and tactics to mitigate. His immediate advice was to expect fewer price increases in 2023, but to beware of bad upside risk. Additionally, he presented that pre-buying could be wise as just-in-time inventory does not work in times of shortages, and that Europe faces a real danger of industry force majeure if they have a cold winter and need to divert natural gas to heat residential homes instead of production, so should consider qualifying alternative sources.

Cultivating Relationships at FMI

Our team always enjoys meeting with our partners! We love getting to know our partners to continue to grow with and support them.

The next FMI Energy & Store Development conference will take place in Baltimore, MD, in October 2023. We hope to see you there!

Share this

- Facilities Management (91)

- Energy Management (69)

- Company News (49)

- Smart Buildings (37)

- Retail (36)

- Building Management (24)

- Building Automation Systems (21)

- Sustainability (20)

- Energy Demand Management (19)

- EEI (15)

- Adaptive Energy Management (14)

- Grocery (14)

- demand response (14)

- Artificial Intelligence (12)

- Data Integration and Visibility (10)

- HVAC IQ (10)

- COVID-19 (8)

- Customer Spotlight (8)

- Carbon Management (7)

- Refrigeration Optimization (7)

- Setpoints and Temperatures (7)

- Equipment Maintenance (6)

- Operational Efficiency (6)

- Ask Ron (5)

- Asset Manager (5)

- Finance and Procurement (5)

- IoT and Digital Transformation (5)

- Awards (4)

- Comfort (4)

- Energy & Store Development (4)

- Safety and Compliance (4)

- Demand Charge Management (3)

- Energy Management System (3)

- Lifecycle Asset Management (3)

- Premium Services (3)

- Refrigeration IQ (3)

- Automated Demand Response (2)

- ConnexFM (2)

- Customer Service (2)

- HVAC Vendor Management (2)

- Load Shedding (2)

- Technician View (2)

- AIM Act (1)

- ALD (1)

- Analytics (1)

- Commissioning (1)

- Data (1)

- Data Integration and Visualization (1)

- EMS (1)

- Knowledge Center (1)

- OSHA (1)

- asset management (1)

- January 2026 (1)

- December 2025 (1)

- November 2025 (1)

- October 2025 (2)

- September 2025 (1)

- August 2025 (3)

- July 2025 (1)

- June 2025 (1)

- May 2025 (2)

- March 2025 (2)

- February 2025 (1)

- January 2025 (2)

- December 2024 (2)

- October 2024 (1)

- September 2024 (1)

- August 2024 (2)

- June 2024 (2)

- April 2024 (2)

- March 2024 (2)

- January 2024 (1)

- December 2023 (1)

- October 2023 (2)

- September 2023 (2)

- August 2023 (2)

- July 2023 (1)

- May 2023 (2)

- April 2023 (2)

- March 2023 (3)

- February 2023 (1)

- January 2023 (1)

- December 2022 (1)

- November 2022 (2)

- October 2022 (2)

- September 2022 (1)

- May 2022 (2)

- April 2022 (1)

- March 2022 (3)

- February 2022 (2)

- January 2022 (4)

- December 2021 (2)

- November 2021 (3)

- October 2021 (1)

- September 2021 (3)

- August 2021 (4)

- July 2021 (1)

- June 2021 (2)

- May 2021 (1)

- January 2021 (2)

- December 2020 (2)

- November 2020 (2)

- October 2020 (3)

- September 2020 (4)

- August 2020 (3)

- July 2020 (2)

- June 2020 (3)

- May 2020 (3)

- April 2020 (5)

- March 2020 (5)

- February 2020 (4)

- January 2020 (4)

- December 2019 (4)

- November 2019 (3)

- October 2019 (4)

- September 2019 (5)

- August 2019 (4)

- July 2019 (4)

- May 2019 (2)

- April 2019 (3)

- February 2019 (1)

- December 2018 (1)

- November 2018 (1)

- October 2018 (3)

- September 2018 (3)

- August 2018 (3)

- July 2018 (3)

- June 2018 (3)

- May 2018 (1)

- June 2015 (1)

- March 2013 (1)

- January 2013 (1)

- December 2011 (1)

- October 2011 (1)

- September 2011 (1)